Welcome to the world of investing in company stock, where opportunities for financial growth and wealth accumulation await. Have you ever wondered how some individuals manage to build substantial wealth? Well, one key aspect lies in investing wisely, and company stock presents an avenue worth exploring.

Mục lục

- 1. The Power of Investing in Company Stock

- 2. Why is Investing in Company Stock Important?

- 3. Benefits of Investing in Company Stock

- 4. Risks of Investing in Company Stock

- 5. Factors to Consider Before Investing in Company Stock

- 6. Strategies for Investing in Company Stock

- 7. Conclusion: Embracing the Power of Investing in Company Stock

The Power of Investing in Company Stock

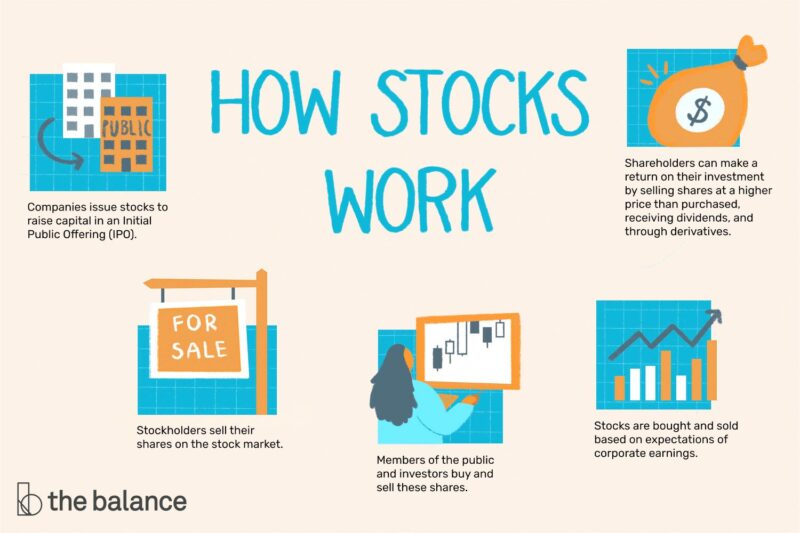

Investing in company stock involves purchasing shares of a specific company, making you a partial owner. As a shareholder, you have the potential to reap numerous benefits, ranging from capital appreciation to dividend payments and even decision-making power within the company. This investment strategy can be a game-changer for your financial journey, offering a unique blend of ownership and opportunity.

Why is Investing in Company Stock Important?

Now, you might be thinking, why should I consider investing in company stock? The answer lies in the potential for long-term capital appreciation. When a company performs well, its stock prices can soar, resulting in substantial returns. Additionally, many companies distribute a portion of their profits to shareholders through dividends, providing you with a steady stream of income.

Furthermore, investing in company stock can grant you ownership and decision-making power within the organization. This means you have a say in the company’s future, amplifying your investment’s impact. Moreover, if you are an employee, your company might offer stock options or incentives, allowing you to benefit directly from its success.

Are you ready to embark on this investment journey and unlock the potential for financial growth? In the following sections, we will explore the benefits and risks associated with investing in company stock, guiding you towards informed decision-making. Let’s dive in and uncover the secrets behind successful investing in company stock!

Benefits of Investing in Company Stock

Investing in company stock offers a myriad of advantages that can greatly impact your financial well-being. Let’s explore some of the key benefits that make this investment strategy enticing:

1. Potential for Long-Term Capital Appreciation

One of the primary benefits of investing in company stock is the potential for long-term capital appreciation. As a shareholder, you have the opportunity to profit from the company’s growth and success. When a company performs well and its value increases, the price of its stock tends to rise as well. By investing in promising companies with a strong track record, you position yourself to enjoy significant returns on your investment over time.

2. Dividend Payments and Income Generation

Another enticing aspect of investing in company stock is the possibility of receiving dividend payments. Dividends are a share of the company’s profits distributed to its shareholders. These payments can provide a steady stream of income, allowing you to benefit from your investment even before you sell your shares. Dividend payments can be particularly appealing for individuals seeking regular income generation.

3. Ownership and Decision-Making Power

When you invest in company stock, you become a partial owner of the organization. This ownership grants you certain rights and privileges within the company. You may have the opportunity to vote on important matters during shareholder meetings and exert influence over the company’s decisions. This sense of ownership not only makes you an active participant in the company’s growth but also aligns your interests with its success.

4. Employee Stock Options and Incentives

For individuals who work for the company they are investing in, employee stock options and incentives present additional benefits. Many companies offer their employees the opportunity to purchase company stock at a discounted price or as part of their compensation package. This allows employees to directly benefit from the company’s performance, creating a sense of loyalty and motivation to contribute to its success.

Investing in company stock offers a unique blend of potential financial growth, income generation, ownership, and employee perks. However, it is important to consider the risks associated with this investment strategy as well. In the next section, we will explore the potential risks and challenges you may encounter on your investment journey. Stay tuned!

Risks of Investing in Company Stock

Investing in company stock comes with its fair share of risks. It is essential to understand and evaluate these risks before diving into any investment. Let’s take a closer look at some of the key risks associated with investing in company stock.

1. Market Volatility and Stock Price Fluctuations

Stock prices are subject to market volatility, meaning they can experience significant fluctuations. External factors such as economic conditions, geopolitical events, and investor sentiment can impact stock prices. These fluctuations can result in both gains and losses, making it crucial to monitor and manage your investments carefully.

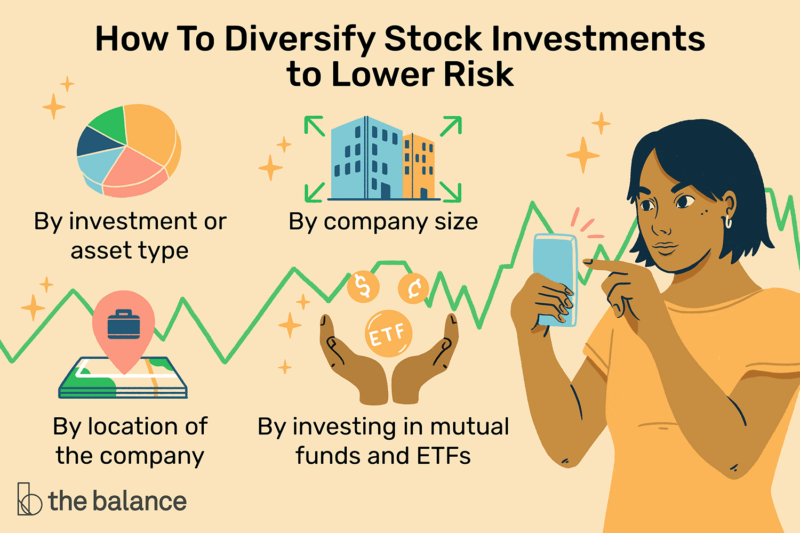

2. Concentration Risk and Lack of Diversification

Investing solely in a single company’s stock exposes you to concentration risk. If the company faces financial difficulties or experiences a decline in its industry, your investment can suffer significant losses. Diversification, on the other hand, involves spreading your investments across different companies and sectors, reducing the impact of any single investment on your overall portfolio.

3. Financial Performance and Business Risks

The financial performance of a company directly affects its stock price. Poor financial results, such as declining revenues, increasing debt, or lackluster profitability, can cause the stock price to plummet. Additionally, companies face various business risks, including competition, technological disruptions, and changes in consumer preferences. Understanding a company’s financial health and evaluating its growth prospects can help mitigate these risks.

4. Regulatory and Legal Risks

Companies operate within a framework of regulations and legal obligations. Regulatory changes or legal issues can have a significant impact on a company’s operations and ultimately its stock price. It is essential to stay informed about any regulatory developments or legal challenges that may affect the company you are investing in.

By being aware of these risks and conducting thorough research, you can make informed investment decisions. In the next section, we will explore the factors you should consider before investing in company stock, helping you navigate the investment landscape with confidence.

Factors to Consider Before Investing in Company Stock

Before diving headfirst into investing in company stock, it is crucial to conduct thorough research and analysis. By considering various factors, you can make more informed decisions and increase your chances of success. Let’s explore some key considerations:

Researching the Company’s Financial Health and Stability

Start by delving into the company’s financial statements, annual reports, and quarterly earnings releases. Look for indicators of financial health, such as consistent revenue growth, profitability, and strong balance sheets. Understanding the company’s financial stability will provide insights into its ability to weather economic downturns and generate sustainable returns.

Analyzing Industry Trends and Market Conditions

Another essential aspect to consider is the industry in which the company operates. Analyze industry trends, growth prospects, and potential disruptors that could impact the company’s performance. Additionally, assess the overall market conditions, evaluating factors like economic indicators, market competition, and regulatory changes. This analysis will help you gauge the company’s position within its industry and assess its growth potential.

Assessing the Company’s Competitive Position and Growth Prospects

Examine the company’s competitive advantages, unique selling propositions, and market share. Consider its ability to innovate, adapt to market changes, and stay ahead of competitors. A company with a strong competitive position is more likely to sustain growth and deliver value to its shareholders in the long run.

Evaluating Management Competence and Corporate Governance

Effective management is crucial for a company’s success. Evaluate the leadership team’s experience, track record, and strategic vision. Additionally, assess the company’s corporate governance practices, such as board composition, transparency, and ethical standards. A company with competent management and strong corporate governance is more likely to make sound decisions and create long-term shareholder value.

By thoroughly considering these factors, you can gain a clearer understanding of the company’s potential and make more informed investment decisions. Remember, investing in company stock requires careful analysis and due diligence. Let’s move on to the next section, where we will explore effective strategies for investing in company stock.

Strategies for Investing in Company Stock

Investing in company stock requires careful planning and strategic decision-making. To maximize your chances of success, it’s essential to employ effective investment strategies. Let’s explore some key strategies that can help you navigate the world of investing in company stock.

1. Dollar-Cost Averaging and Regular Investment

One popular strategy is dollar-cost averaging. Instead of investing a lump sum all at once, you gradually invest a fixed amount at regular intervals, regardless of the stock price. This approach allows you to buy more shares when prices are low and fewer shares when prices are high. Over time, this strategy can help smooth out market fluctuations and potentially lower your average cost per share.

2. Setting Realistic Goals and Time Horizon

When investing in company stock, it’s crucial to define your goals and determine your investment time horizon. Are you aiming for long-term growth or seeking short-term gains? Understanding your objectives will guide your investment decisions and help you stay focused. Setting realistic expectations and aligning them with your time horizon can prevent impulsive decisions and provide a clear roadmap for your investment journey.

3. Portfolio Diversification and Risk Management

Diversification is a fundamental strategy to mitigate risk. Instead of investing solely in one company’s stock, consider building a diversified portfolio that includes stocks from various industries and sectors. This diversification helps spread your risk and reduces the impact of any single company’s performance on your overall portfolio. Additionally, regularly monitoring and rebalancing your portfolio can help maintain a healthy risk-to-reward ratio.

4. Monitoring and Adjusting the Investment Strategy

Investing in company stock is not a “set it and forget it” endeavor. It’s crucial to stay informed and actively monitor your investments. Keep an eye on company news, market trends, and financial performance to ensure your investment thesis remains intact. If necessary, be willing to make adjustments to your investment strategy to align with changing market conditions or company circumstances.

By incorporating these strategies into your investment approach, you can enhance your chances of success when investing in company stock. Remember, every investment carries some level of risk, so staying informed, diversifying your holdings, and maintaining a disciplined approach will help you navigate the ever-evolving stock market landscape. Stay focused, adapt to market dynamics, and let your investment portfolio flourish.

Conclusion: Embracing the Power of Investing in Company Stock

Congratulations on reaching the end of this enlightening journey into the world of investing in company stock! By now, you understand the immense potential this investment strategy holds for your financial growth. Investing in company stock offers a unique opportunity to become a part-owner, granting you access to capital appreciation, dividend payments, and even decision-making power within the company.

Throughout this article, we have explored the benefits and risks associated with investing in company stock. We discovered how the potential for long-term capital appreciation can pave the way to financial success. We also discussed the income-generating power of dividend payments and the value of ownership and decision-making rights.

However, it is crucial to approach investing in company stock with caution. We discussed the risks, such as market volatility, lack of diversification, and regulatory concerns. It is vital to conduct thorough research, analyze industry trends, evaluate financial health, and assess management competence before making investment decisions.

Remember, investing in company stock requires strategic thinking and a long-term perspective. Set realistic goals, diversify your portfolio, and regularly monitor and adjust your investment strategy. If needed, consult a financial advisor who can provide expert guidance tailored to your unique circumstances.

At investment.ebest.vn, we believe in empowering individuals to make informed investment decisions. We strive to provide you with valuable insights and resources to navigate the complex world of investing. So, why wait? Take the first step towards financial growth by embracing the power of investing in company stock.

Remember, the world of investing is ever-evolving, and staying informed is key. Subscribe to our newsletter and stay updated on the latest investment trends, strategies, and market news. Together, let’s unlock your financial potential through investing in company stock!