In today’s fast-paced world, financial stability is a priority for many. If you find yourself burdened by high-interest credit card debt, there is a solution that can alleviate your worries – 0 balance transfer credit card offers. These offers provide an opportunity to transfer your existing credit card debt to a new card with a 0% interest rate for a specified period.

Mục lục

Why is finding the right credit card offer crucial?

Picture this: you have a mountain of credit card debt, and each month, the interest charges continue to pile up. It can feel overwhelming, like being stuck in quicksand. But fear not, because the right credit card offer can be your saving grace. By taking advantage of 0 balance transfer credit card offers, you can free yourself from the shackles of high-interest rates and make significant progress towards paying off your debt.

The benefits of 0 balance transfer credit cards

Imagine being able to make payments towards your debt without worrying about interest charges slowing down your progress. With 0 balance transfer credit cards, this dream becomes a reality. By transferring your existing debt to a card with a 0% interest rate, you can save a substantial amount of money in interest payments and potentially pay off your debt faster.

But that’s not all. These credit cards offer more than just interest savings. They also provide a convenient way to consolidate your debt, making it easier to manage your finances. Instead of juggling multiple payments and due dates, you can streamline your debt into one monthly payment, simplifying your financial life.

In addition, responsible usage of 0 balance transfer credit cards can positively impact your credit score. By making timely payments and reducing your overall debt, you demonstrate financial responsibility to creditors, which can boost your creditworthiness over time.

In the next section, we will delve deeper into understanding how 0 balance transfer credit cards work and the advantages they offer. So, buckle up and get ready to embark on a journey towards financial freedom!

“Are you tired of drowning in credit card debt? Discover the power of 0 balance transfer credit card offers and liberate yourself from the burden of high-interest rates. Let’s explore the benefits together!”

Understanding 0 Balance Transfer Credit Cards

A. Definition and Purpose of 0 Balance Transfer Credit Cards

Let’s start by deciphering the concept behind 0 balance transfer credit cards. These financial tools are designed to help individuals transfer their existing credit card debt to a new card that offers a 0% interest rate for a specified period. Essentially, it allows you to move your debt from high-interest cards to a more favorable and cost-effective option.

The primary purpose of 0 balance transfer credit cards is to provide a temporary respite from interest charges. By eliminating or significantly reducing the interest rate on your transferred balance, you can focus on repaying the principal amount without the constant burden of accumulating interest. This can be a game-changer in your journey towards debt freedom.

B. How These Cards Work and Their Advantages

Now that we understand the essence of 0 balance transfer credit cards, let’s explore how they work and the advantages they bring to the table. When you are approved for a 0 balance transfer credit card, you will have the opportunity to transfer your existing credit card debt to the new card. This process involves moving the outstanding balance from your old card(s) to the new card, typically with a nominal transfer fee.

Once the transfer is complete, you will enjoy a grace period during which the transferred balance will accrue zero or minimal interest, usually for a fixed duration. This period can range from several months up to a year, depending on the specific credit card offer. It’s important to note that any new purchases made on the 0 balance transfer credit card may accrue interest at the regular rate, so it’s advisable to focus on paying off the transferred balance first.

The advantages of 0 balance transfer credit cards are manifold. Firstly, the ability to save on interest payments can make a significant impact on your finances. By redirecting those funds towards paying down your principal balance, you can make substantial progress in reducing your debt.

Secondly, consolidating your debt into a single card simplifies your financial management. Instead of juggling multiple creditors and due dates, you’ll have one monthly payment to keep track of, streamlining your efforts and reducing the chances of missed payments.

C. Factors to Consider Before Applying for a 0 Balance Transfer Credit Card

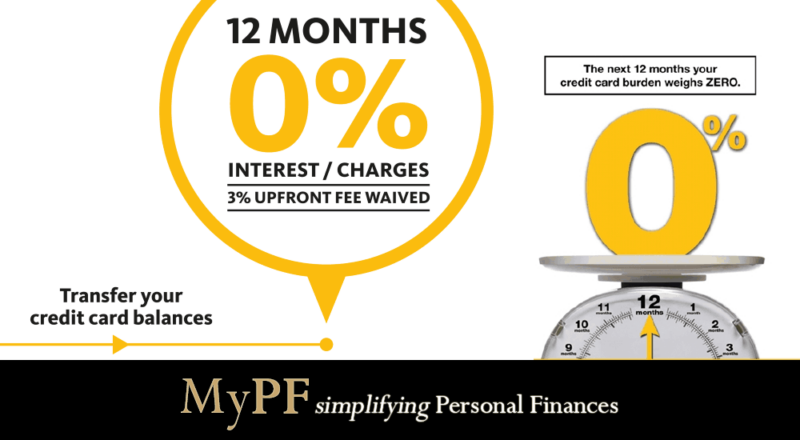

Before diving into the world of 0 balance transfer credit cards, it’s crucial to consider a few factors that can affect your decision-making process. Firstly, take note of the transfer fee associated with the card. While the interest savings can be significant, some cards may charge a fee based on a percentage of the transferred balance. It’s essential to weigh this fee against potential interest savings to ensure it aligns with your financial goals.

Additionally, pay attention to the duration of the 0% interest period. A longer duration allows more time to repay your debt without accruing interest. Consider your repayment capabilities and choose a card that provides a suitable timeframe for your circumstances.

Lastly, be mindful of the ongoing APR (Annual Percentage Rate) once the promotional period ends. If you anticipate carrying a balance beyond the interest-free period, it’s essential to understand the regular interest rate to ensure it aligns with your financial plans.

By considering these factors, you can make an informed decision when selecting the right 0 balance transfer credit card for your needs. In the next section, we will explore the benefits of these offers in more detail, shedding light on the potential savings and debt management advantages they provide.

“Unlock the secrets of 0 balance transfer credit cards and take control of your debt journey. Discover how these cards work, their advantages, and the factors to consider before applying. Let’s pave the way towards a debt-free future!”

Benefits of 0 Balance Transfer Credit Card Offers

Lower interest rates and potential savings

When it comes to 0 balance transfer credit card offers, one of the most enticing benefits is the opportunity to enjoy lower interest rates. As the name suggests, these cards allow you to transfer your existing credit card debt to a new card that offers a 0% introductory APR (Annual Percentage Rate) for a certain period. This means that during the introductory period, you won’t accrue any interest on the transferred balance.

By taking advantage of this promotional period, you can save a significant amount of money in interest charges. Imagine how much you could save if you were no longer paying 20% or more in interest each month. It’s like putting money back into your pocket and accelerating your journey towards debt freedom.

Consolidating debt and managing payments effectively

Another key benefit of 0 balance transfer credit cards is the ability to consolidate your debt into a single payment. Instead of juggling multiple credit card bills with different due dates, you can streamline your finances by transferring all your balances onto one card. This simplifies your payments, making it easier to keep track of and manage your debt.

Consolidation not only saves you from the hassle of remembering multiple due dates but also allows you to potentially negotiate better repayment terms. With a single payment, you have a clearer picture of your overall debt, enabling you to strategize and allocate your resources more effectively.

Improving credit scores with responsible credit card usage

Did you know that 0 balance transfer credit cards can also help improve your credit score? When you transfer your balances to a new card, it shows responsible credit utilization and can positively impact your creditworthiness. By lowering your credit utilization ratio, which is the amount of available credit you’re using, you demonstrate to lenders that you are a responsible borrower.

Moreover, as you make timely payments and reduce your overall debt, your credit score may gradually improve. This is because payment history and credit utilization are two vital factors that influence your credit score. So, by effectively managing your 0 balance transfer credit card and making responsible financial decisions, you have the potential to strengthen your creditworthiness.

Now that we have explored the benefits of 0 balance transfer credit card offers, let’s move on to the next section, where we will provide valuable tips to help you find the best offers available. Stay tuned, as your path to financial freedom is just beginning!

“Lower interest rates, streamlined payments, and credit score improvements – 0 balance transfer credit card offers bring a trifecta of benefits to the table. Discover how these advantages can transform your financial journey!”

Tips for Finding the Best 0 Balance Transfer Credit Card Offers

When it comes to finding the best 0 balance transfer credit card offers, a little research can go a long way. Here are some essential tips to help you navigate through the options and find the perfect card for your needs.

A. Researching and comparing different credit card options

Before diving into any credit card offer, it’s important to conduct thorough research. Start by exploring various credit card providers and their offerings. Look for reputable institutions with a track record of excellent customer service and competitive rates.

Next, compare the features and benefits of different 0 balance transfer credit cards. Consider factors such as the length of the introductory period, the ongoing APR, and any associated fees. Keep an eye out for additional perks, such as rewards programs or cashback incentives, that align with your financial goals.

B. Understanding the terms and conditions of balance transfers

While the allure of 0% interest may be tempting, it’s crucial to understand the terms and conditions of balance transfers. Take the time to read the fine print and ensure you comprehend the requirements and limitations of the offer.

Some important details to consider include the balance transfer fee, which is typically a percentage of the amount transferred. Additionally, be aware of any restrictions on the types of debts eligible for transfer. Understanding these terms will help you make an informed decision and avoid unexpected surprises down the road.

C. Evaluating fees, introductory periods, and ongoing APRs

When comparing 0 balance transfer credit card offers, it’s essential to evaluate the associated fees, introductory periods, and ongoing APRs. While a longer introductory period may seem enticing, it’s important to weigh it against other factors.

Consider the balance transfer fee mentioned earlier, as well as any annual fees or other charges that may come with the card. Additionally, take note of the ongoing APR that will apply once the introductory period ends. Finding a balance transfer credit card with a competitive ongoing APR can help you save money in the long run.

By researching, understanding the terms, and evaluating the fees and APRs, you can confidently choose the best 0 balance transfer credit card offer that suits your financial needs.

“Don’t settle for just any 0 balance transfer credit card offer. Follow these tips to uncover the hidden gems and find the perfect card that aligns with your financial goals. Let’s dive into the details together!”

How to Apply for a 0 Balance Transfer Credit Card

Gather the Necessary Documents and Information

Before diving into the application process, it’s essential to gather all the necessary documents and information to ensure a smooth and efficient application. To increase your chances of approval, you will typically need:

- Proof of identification: Prepare a valid government-issued ID, such as a passport or driver’s license, to verify your identity.

- Proof of income: Lenders want to ensure you have the means to repay the debt. Collect recent pay stubs, bank statements, or tax returns to demonstrate your income stability.

- Credit history: Gather information about your current credit cards, outstanding debts, and credit score. This will help the lender assess your creditworthiness and determine the credit limit they can offer.

- Existing credit card statements: If you plan to transfer your balance from another credit card, have your most recent statements ready to provide accurate details during the application process.

Step-by-Step Guide to the Application Process

Now that you have your documents in order, let’s walk through the step-by-step process of applying for a 0 balance transfer credit card:

- Research and compare offers: Start by exploring different credit card companies and their 0 balance transfer offers. Compare factors such as introductory periods, ongoing APRs, and any associated fees.

- Choose the right card: Select the card that aligns with your financial goals and requirements. Consider factors like the length of the introductory period, the ongoing interest rate after the promotional period, and any additional benefits the card offers.

- Visit the issuer’s website: Once you’ve decided on a specific credit card, visit the issuer’s website to access the online application form.

- Complete the application: Fill out the application form accurately and provide all the requested information. Double-check for any errors before submitting the application.

- Submit supporting documents: If required, upload or mail the supporting documents mentioned earlier to verify your identity, income, and credit history.

- Wait for approval: After submitting your application, the credit card issuer will review your information. The approval process may take a few days to a few weeks. Be patient during this time.

Tips for Increasing Approval Chances and Avoiding Common Mistakes

To increase your chances of approval and avoid potential pitfalls, keep the following tips in mind:

- Maintain a good credit score: A higher credit score enhances your eligibility for 0 balance transfer credit card offers. Pay your bills on time, keep your credit utilization low, and avoid opening multiple new credit accounts simultaneously.

- Read the fine print: Carefully review the terms and conditions of the credit card offer, paying attention to any fees, balance transfer limits, and expiration dates of promotional rates.

- Avoid unnecessary credit inquiries: Applying for multiple credit cards within a short period can negatively impact your credit score. Only apply for cards that you genuinely need and meet the eligibility criteria.

- Be truthful and accurate: Provide honest and accurate information in your application. Any discrepancies or false information can lead to rejection and potential legal consequences.

By following these steps and tips, you’ll be well-prepared to apply for a 0 balance transfer credit card and increase your chances of approval. So gather your documents, choose the right card, and take the first step towards a debt-free future!

“Ready to take control of your credit card debt? Let’s dive into the step-by-step process of applying for a 0 balance transfer credit card. From gathering the necessary documents to avoiding common mistakes, I’ve got you covered!”

Conclusion

In conclusion, 0 balance transfer credit card offers can be a game-changer when it comes to managing your credit card debt effectively. By taking advantage of these offers, you can save on interest charges, consolidate your debt, and make significant strides towards financial freedom.

When searching for the right 0 balance transfer credit card offer, remember to do your due diligence. Research and compare different options, considering factors such as fees, introductory periods, and ongoing APRs. Understanding the terms and conditions of balance transfers is crucial to make informed decisions and avoid unexpected surprises down the road.

Applying for a 0 balance transfer credit card is a straightforward process. Gather the necessary documents and information, follow the application steps diligently, and increase your chances of approval by presenting yourself as a responsible borrower. Avoid common mistakes and pave the way for a successful application.

At erp.ebest.vn, we believe in empowering individuals to take control of their finances. With 0 balance transfer credit card offers, you have the opportunity to break free from the cycle of high-interest debt and pave the way for a brighter financial future. Remember, responsible usage is key to maximizing the benefits of these offers and improving your credit score.

So, why wait? Explore the world of 0 balance transfer credit cards today and start your journey towards financial freedom. Take the first step and unlock the potential to save money, consolidate debt, and build a solid foundation for a secure financial future. At erp.ebest.vn, we are here to support you every step of the way.